Week 9.3 Selecting a Price Level

You have seen steps 1, 2, and 3 in the process of setting a price in the previous lessons. In this lesson, we will cover step 4.

Steps in Setting Price: 4) select an approximate price level

©University of Waterloo

There are four common approaches in selecting an approximate price level. These four approaches are shown in the figure below.

Four Orientations in Selecting an Approximate Price Level. 1) demand-oriented approaches, 2) cost-oriented approaches, 3) profit-oriented approaches, and 4) competition-oriented approaches.

©University of Waterloo

Let us examine each one of these four orientations in details.

Demand-Oriented Approaches

Demand-oriented pricing focuses on the customer side such as expected customer tastes and preferences more heavily than other factors. Demand represents customers’ willingness to pay, which comes from customers' tastes, evaluations of the product, interests, preferences, etc.

Demand orientation involves the following pricing methods:

- Skimming pricing

- Penetration pricing

- Prestige pricing

- Price lining pricing

- Odd-even pricing

- Target pricing

- Bundle pricing

- Yield management pricing

Skimming Pricing

Price is set to the highest initial price level that customers who really desire the product/service are willing to pay. Especially new or innovative products attract early buyers who believe that trying the product/service before the majority of the market is a privilege. The idea with skimming pricing is to take advantage of these price-insensitive buyers with the high price. As these customers' demand is satisfied, the firm might lower the price to attract another, perhaps more price-sensitive segment.

Retrieved from https://www.blueorigin.com/gallery

Example: Space tourism is attracting early buyers. Some agencies are selling tickets priced at $200,000 - $250,000 per person.

Skimming pricing is an effective strategy when the following are true:

- There are enough early buyers who are willing to buy the product immediately at the high initial price.

- The high initial price will not attract competitors. High price signals to the potential competitors that there is the possibility of profit in this market. It acts like an invitation to potential rivals.

- Lowering the price has only a minor effect on increasing the sales volume and reducing the unit costs.

- Customers interpret the high price as signifying high quality. The relationship between price and quality might help increase sales.

Penetration Pricing

Penetration pricing is the opposite of skimming pricing. The firm sets the price low initially to appeal to the mass market.

Penetration pricing is an effective strategy when the following are true:

- Many segments of the market are price sensitive. This means that high price would significantly lower sales and revenue. It is better to go in with a lower price.

- A low initial price discourages entry by competitors. High price might attract competition as it signals profitability.

- Unit total costs fall dramatically as sales volume increases. Economies of scale allow firms to lower their costs as they produce and sell large amounts of goods.

A firm applying penetration pricing may maintain the initial low price, or lower the price even further hoping that higher sales volume would generate higher profit. Of course, the firm pays attention to controlling the costs, as cost matters when calculating profit. In some cases penetration pricing follows skimming pricing. The initial high price helps attract price-insensitive consumers, which allows for covering initial research and development costs. After that, penetration pricing is used to capture broader segments of the population.

Retrieved from https://www.amazon.ca/Fire-Tablet-

Display-GB-Black/dp/B071X562MF/

Example: Amazon applied penetration pricing when they introduced the Amazon Fire tablet computer. The price was $199 while substitute products were priced at $499.

Prestige Pricing

Businesses set a high price so that quality- or status-conscious consumers will be attracted to the product and buy it. For products/services with prestige attachment, lower price would reduce their sales since consumers signal their status with using or consuming such products/services.

Retrieved from http://www.autoexpress.co.uk/rolls-

royce/101203/2017-rolls-royce-phantom-pictures

Example: A car by Rolls-Royce, or perfume by Chanel are attractive to status-conscious consumers.

Price Lining Pricing

Some firms sell not a single product but a line of products. It is called a price lining strategy when the firm prices the products at a number of different specific pricing points. Even though the cost of all of the items in the same product line might be the same, they are priced differently based on demand and preferences of consumers.

Tarzhanova/iStock/Getty Images

Example: A discount retailer store manager may price a line of women's dresses at $29, $49, and $69 even though their cost to the retailer is the same. The price lining strategy is based on the demand from consumers. Some dresses sold out quickly while there was less interest in others. This could be due to the colours and styles of the dresses.

Odd-Even Pricing

The price is set a few dollars or cents under an even number. It creates the illusion that the price is less than what it really is.

Retrieved from https://www.walmart.ca/

en/ip/great-value-3-ply-facial-tissue-

papers/6000196611248

Example: The price of 3-Ply facial tissue in Walmart is $9.99. Consumers perceive the price as a single digit number such as $9 rather than $10.

Target Pricing

Seller deliberately adjusts the composition and features of a product to achieve its target price to consumers. Target price is determined by marketers based on their research on the willingness to pay by the consumers. That is the price the consumers should see on the price tag on the retailers. Marketers work backward through markups taken by retailers and wholesalers to determine what price the manufacturer can charge the wholesalers for the product. This practice is called target pricing.

Retrieved from http://www.canon.ca/en

/products/Cameras

Example: Canon uses target pricing when pricing its cameras.

Bundle Pricing

Bundle pricing means that two or more products are sold in a single "package" price. It helps the seller lower its marketing costs since marketing two products together as a single package costs less than marketing two products separately. These cost savings are often reflected to the buyers in the form of lower prices. It also helps consumers save time since they do not have to search for and book two products separately.

Retrieved from http://vacations.aircanada.com/en/ideas/activities/

suggestions/recommendations/promotions/Canada/40963#

Example: Air Canada offers vacation packages that include airfare, car rental, and lodging.

Yield Management Pricing

Yield management pricing is the practice of charging different prices to maximize revenue for a set amount of capacity at any given time. The price of the same product differs based on time, day, week, month, or season. As you have found in the previous lessons, capacity management is especially important for service organizations.

Retrieved from https://www.hollandamerica.com/en_US/cruise-ships.html

Example: Seats on Air Canada flights are priced differently within the economy class based on the booking time. Many airlines, hotels, cruise ships, and car rental companies use yield management pricing.

Name Your Price

Retrieved from https://www.panerabread.com/en-us/

menu-categories/freshly-baked-breads.html

There are other demand-oriented pricing strategies such as an experimental approach by Panera Bread. It is called a "name your price" or "pay what you think it is worth" pricing model. The goal is to provide everyone with a nutritious meal regardless of their status. There are suggested donation amounts on the menu board listing the price for the meal at a regular café but ultimately the customer makes the decision on how much to leave. About 15-20% leave less than what it costs or nothing at all, while 60% pay the suggested amount. The remaining 15-20% leave more than the suggested price. This is an experimental pricing strategy. It is not applied in every Panera Bread location but only in "Panera Cares Cafes".

Cost-Oriented Approaches

In cost orientation, the attention moves away from the demand side and focuses on the supply side with cost considerations. As you have seen in the earlier lessons, profit will not be positive unless the revenues from the sale of the product/service exceed all costs including the production and marketing costs.

There are three approaches in cost-oriented pricing:

- Standard markup pricing

- Cost-plus pricing

- Experience curve pricing

Standard Markup Pricing

The seller adds a fixed percentage to the cost of all items in a specific product class. The added percentage depends on the product's sales volume. High-volume products usually have smaller markups than do low-volume products.

GMVozd/E+/Getty Images

Example: Most retailers and supermarkets apply standard markup pricing. For example, Sobeys has different markups for staple items, such as sugar, flour, and dairy products (10-23%), and discretionary items, such as snack foods and candy (27-47%).

Cost-Plus Pricing

The goal is to make sure that the cost is fully covered. The seller takes the total unit cost of providing a product or service, and adds a specific amount to the cost to set the price. It is very commonly used in setting prices for business products.

3xy/iStock/Getty Images

Example: Law firms apply cost-plus pricing to most of their business clients. Billing businesses on an hourly basis would make it unaffordable for some business clients. Instead, lawyers and their clients agree on a fixed fee based on expected costs plus a profit for the law firm.

Experience Curve Pricing

As firms produce the same product/service on a larger scale, a learning effect takes place. Over time, the producer is able to lower the unit variable cost as management figures out the most cost-effective production method. The unit cost of many products/services declines by 10 to 30% each time a firm's experience at producing/selling them doubles. This lower cost is often reflected in lower prices for the consumer.

scanrail/iStock/Getty Images

Example: The price of high-tech electronic products such as HDTVs comes down as the firms are able to lower their costs over time.

Profit-Oriented Approaches

Profit orientation requires setting the price to achieve targeted profits, return on sales, or return on investment.

There are three profit-orientated pricing strategies:

- Target profit pricing

- Target return-on-sales pricing

- Target return-on-investment pricing

Target Profit Pricing

Managers might have an annual target of a specific dollar amount of profit. They set the price in order to meet the targeted profit.

DarioGaona/iStock/Getty Images

Example: Victoria is the manager of a bakery in your neighborhood. She calculates the following figures before applying target profit pricing.

- Variable cost is $5 per unit.

- Fixed cost is $30,000.

- Demand is insensitive to price up to $10 per unit.

- A target profit of $100,000 is sought at an annual volume of 55,000 units sold.

We set the profit equal to the target of $100,000, and use total revenue and total cost in order to solve for the price.

Stop and Think Question: In the example above, what is the price based on target profit pricing? Click reveal after you solve this problem.

Click to reveal answer.

We set the profit equal to the target of $100,000 and use total revenue and total cost in order to solve for the price.

Profit = TR – TC = (PxQ) – (FC + (UVC x Q))

100,000 = (P x 55,000) – (30,000 + (5 x 55,000))

55,000P = 100,000 + 30,000 + 275,000

55,000P = 405,000

P = $7.36

Please note the importance of the assumption that demand is insensitive to price up to $10 per unit. This means that the bakery will be able to sell an expected quantity of 55,000 units as long as the price is below $10. For a price above $10, the quantity demanded will fall significantly, which will affect the profit calculation. Since Victoria knows about elasticity, she calculated price elasticity of demand to test the price sensitivity of her buyers.

Target Return-on-Sales Pricing

Target profit pricing assumes a sales volume based on sensitivity of demand. The method of target return-on-sales connects the sales volume to profit with a specific percentage. Many firms such as supermarket chains often use target return-on-sales pricing that will give the firm a profit that is a specified percentage of sales volume.

Example: The price is set to achieve a profit that is equal to 5% of the sales volume.

Target Return-on-Investment Pricing

Some firms require large amounts of fixed costs when setting up their businesses. Examples are firms such as GM, and many public utilities. Due to the high fixed costs and investment requirements, managers set annual return-on-investment (ROI) targets in pricing.

Example: The price is set to achieve a ROI of 20%.

Competition-Oriented Approaches

This orientation focuses on the behaviour of competitive firms in the market.

There are three competition-oriented strategies:

- Customary pricing

- Above-, at-, or below–market pricing

- Loss-leader pricing

Customary Pricing

For some products, tradition or standardized channels of distribution might dictate the price. Customary pricing is applied in such cases. A difference in price might lead to loss of the distribution channel and market share.

NicholasMcComber/iStock

/Getty Images

Example: Vending machines are considered a type of distribution channel. Customary pricing of 75 cents is applied to chocolate bars that are offered through vending machines. If the price is significantly higher than the customary price, it might not be possible to sell the bars in vending machines. As the cost of chocolate and other ingredients increased, Hershey changed the amount of chocolate in its chocolate bars in order to keep the price the same, so that their sale by vending machines was not affected.

Above-, At-, or Below-Market Pricing

Some companies charge above-market prices while others charge at-market or below-market prices. Their decision is related to brand recognition.

Retrieved from https://www.rolex.com/

Examples: Rolex makes and sells one of the most expensive watches you can ever buy. Rolex’s pricing strategy is an example of above-market pricing. Bed Bath & Beyond and Hudson's Bay generally use at-market pricing. Walmart follows a below-market pricing strategy.

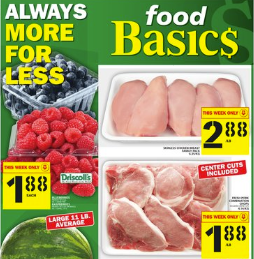

Loss-Leader Pricing

Retail stores apply special promotions by deliberately selling products below their market prices to attract attention to them. The idea is to increase traffic to the store. Even though the retailer might incur a loss from the particular items priced below market price, profits increase as a result of higher traffic. Customers buy other products as well, particularly discretionary items carrying large markups.

Retrieved from https://www.foodbasics.ca

/flyer.en.html

Example: Food Basics advertises certain produce in their flyers weekly. As people go to the store to buy advertised items, they also shop for their other needs, which might carry large markups.