Week 9.1 Identifying Pricing Constraints and Objectives

Importance of Pricing

This week, we introduce pricing strategies and constraints. Price is set as a result of a process. We will examine six steps in setting price with details. Let us get started with the definition of price.

Stop and Think Question: What is price from a marketing viewpoint? Think about the answer, then click reveal for the answer.

Click to reveal answer

LisLud/iStock/Getty Images

Price is the money or other considerations (including other goods and services) exchanged for the ownership or use of a good or service.

In today’s terms, price is usually money. However, it is possible to find examples of other considerations used as price.

Retrieved from http://reports.shell

.com/sustainability-report/2012

/ouractivities/biofuels/raizen.html

Example: Shell Oil exchanged one million pest-control devices for sugar from a Caribbean country.

The practice of exchanging goods and services for other goods and services rather than for money is called barter. It is practiced when it is mutually beneficial for all parties engaged in the deal.

Value Pricing

Marketers often engage in the practice of value pricing.

Value pricing refers to increasing product or service benefits while maintaining or decreasing price.

Even if the price is kept the same, increasing benefits provides higher value for consumers.

kaisorn/iStock/Getty Images

Example: You pay $12.99 for a medium pizza. If the seller offers a deal of a large pizza at the same price, it adds more value for the consumers.

When using price as an indicator of value, we should be careful about what it implies. In some cases, especially for services, there is a perceived relationship between price, quality, and value. For example, low price might imply poor quality, and ultimately, poor perceived value. We have seen an example in the previous lessons about a dental procedure that is priced at $30. What would be your perception of a dentist who charges only $30 for a dental procedure?

Profit and Pricing

Profit driven organizations pay close attention to pricing as it plays an important role in profits.

Profit = Total Revenue – Total Cost = TR - TC

Profit = (Unit price x Quantity sold) – Total cost

Pricing decisions directly influence total revenue, which is a part of profits. Pricing also affects the quantity demanded/sold. We will examine the demand effects in break-even profit calculations in the coming lessons this week.

There are six major steps involved in the process of organizations setting their prices. Each step will be examined in detail.

Steps in Setting Price. 1) identify pricing constraints and objectives, 2) estimate demand and revenue, 3) estimate cost, volume, and profit relationships, 4) select an approximate price level, 5) set list or quoted price, and 6) make special adjustments to list or quoted price.

©University of Waterloo

Step 1: Identify Pricing Constraints and Objectives

Pricing constraints are the factors that limit the latitude of prices that a firm may set. There are many constraints on pricing. We will consider the following factors as the main pricing constraints:

- Demand for the product class, product, and brand

- Newness of the product: stage in the product life cycle

- Single product vs. a product line

- Cost of producing and marketing the product

- Cost of changing prices and time period they apply

- Types of competitive markets

- Competitors’ prices

Let us take a look at the seven constraints listed above individually.

1. Demand for the Product Class, Product, and Brand

Demand plays a major role in pricing. Demand represents the willingness to buy at a given price. The number of potential buyers for the product class, such as cars; products, such as sports cars; and brand, such as KIA, affect the price. Whether the item is a necessity, such as a roof over your head, or a luxury item, such as a 5-star vacation, also matter in pricing. As we change the price, quantity demanded responds to the change. In the coming lessons, we will consider price elasticity of demand in examining the responsiveness of demand. We will also take a look at the factors shifting demand.

2. Newness of the Product: Stage in the Product Life Cycle

The newer a product and the earlier it is in its life cycle, the higher the price that can usually be charged. The goal is to take advantage of price insensitive buyers for a new product. We mentioned skimming pricing as a possible pricing strategy for new products in the previous lessons but it is not the only choice for new or existent products. We will cover skimming pricing in great detail in the coming lessons.

3. Single Product vs. a Product Line

Single product means that it is the only version of the product in the market. As the product gains market share, companies create additional versions of the product in order to satisfy the differing needs of their market segments. Once the initial price is set for the single product in the introduction stage, the pricing of other versions on the product line as they are introduced in later stages, must be aligned with the initial price.

Retrieved from https://support.apple.com/en-us/ht201471

Example: When Apple introduced its iPad, the fact that it was a unique product in the introductory stage of its product life cycle gave Apple a lot of latitude in setting the price. It was the first commercially successful tablet device sold. As other versions were introduced, they were priced based on how much innovation each product carried compared to the first one.

4. Cost of Producing and Marketing the Product

As mentioned above, profit equals total revenue minus total cost. Firms can sustain some loss in the introductory stage until they build their market share. However, in the long run a firm's price must cover all the costs of producing and marketing a product. Otherwise, it is not possible to survive. That is why, in the long run, a firm's costs set a floor under its price.

5. Cost of Changing Prices and Time Period They Apply

There is a cost associated with changing or updating prices. For example, retailers must update all the pricing on the shelves when they change prices. Another example would be restaurants: they must print new menus when they update their pricing. Due to the associated costs of printing new catalogs, research indicates that most firms change the price for their products once a year. One exception would be the online retailers. There is no printing costs for price changes online. It can take just a minute to activate a price change for online sellers.

6. Types of Competitive Markets

There are four types of competitive markets: monopoly, oligopoly, monopolistic competition, and pure (or perfect) competition. We previously covered these four market structures as a part of competitive forces with details and examples. The figure below provides a simple summary including extent of price competition, product differentiation, and advertising.

Pricing, Product, and Advertising Depend on Market Structure. Monopoly has no price competition, no product differentiation, and little need for advertising. Oligopoly has some price competition, a varied need for product differentiation based on industry, and has some need for advertising. Monopolistic competition has some price competition, some need to differentiate, and much need for advertising. Perfect competition has almost no price competition, no product differentiation, and little need for advertising.

©University of Waterloo

One highlight from the above figure would be related to the extent of advertising. There is not much need for advertising in pure competition due to the fact that the products offered in the market are identical. Availability of products can be advertised but there is no point of advertisement to emphasize how the product is superior in the case of pure competition.

Pure monopolistic markets do not require much advertisement either. That is due to fact that monopolists sell products with no close substitutes. Consumers have no other choice if they are interested in such a product sold by a monopolist. Of course it is possible to advertise to raise awareness, if the product is not a necessity.

In oligopolistic markets, products can be undifferentiated such as aluminum, or differentiated such as jetliners. For that reason, some informative advertising is used. Firms avoid head-to-head price competition in oligopolistic markets in order to maximize their profits collectively.

The need for advertising arises in monopolistically competitive markets. In monopolistic competition products are differentiated, which raises the need for firms to advertise in order to highlight their products’ superior characteristics, and differentiate their brand from competitors.

7. Competitors’ Prices

Price is one of the marketing mix elements, and firms have control over price in some markets. For example, a monopolist is a price setter and has full control over pricing unless it is regulated by the government. In perfectly competitive markets, firms are price takers and have no control over the market price. In oligopolies, firms avoid competing on price since it reduces their collective profits. In monopolistic competition, firms have control over pricing and pay close attention to competitors’ prices. As the firm sets its price, it is meaningful to compare the features of the product to the competitive products in order to justify a higher than or lower than market price.

Identifying Pricing Objectives

Step 1 also includes identifying the pricing objectives. Pricing objectives are the expectations that specify the role of price in an organization's marketing plan. Businesses might choose to follow one of many pricing objectives including: profit, sales revenue, market share, unit volume, survival, and social responsibility.

Profit Objective

Firms might choose to maximize their current profits or long-run profits with their pricing. Maximizing their current profit objective, such as during this quarter or year, is common due to the fact that performance is evaluated and the results are realized quickly. The downside of short-run profit orientation, is that firms might sacrifice quality in order to achieve immediate profit.

When firms choose to follow pricing for optimum long-run profits, as is the case for Japanese firms producing cars or computers, they are willing to forgo immediate profit to develop quality products that will dominate the markets in the future.

Firms might follow a target return objective as well. It involves a firm setting a goal (such as 20%) for return on investment (ROI).

ROI = (Net profit after taxes / Investment) × 100%

Sales Revenue Objective

Sales revenue equals price times quantity sold. Firms might follow a pricing objective that will help them increase their sales revenue. Higher sales revenue does not imply higher profits, since cost is also a part of profits. However, an increase in sales revenue would lead to an increase in market share.

Market Share Objective

Market share is the ratio of the firm's sales revenues or unit sales to those of the industry. Gaining more market share makes the firm’s brands recognized and increases sales revenue. Firms might price their products with the objective of increasing their market share.

Unit Volume Objective

Businesses might use unit volume, the quantity sold, as a pricing objective. Price and quantity demanded are negatively correlated based on the law of demand. Reducing price leads to higher quantity demanded. The impact on revenue depends on the elasticity of demand, which we will define in the next lesson.

Survival Objective

In some cases, profits, sales revenue, unit volume, and market share are less important objectives for the firm than survival. Competition in the markets might force some firms to lower their prices to a level that starts incurring losses.

Retrieved from http://www.toysrus.ca

Example: Most specialty-toy retailers such as Toys"R"Us are unable to survive due to the social and competitive forces. Competition from retailers such as Walmart or online retailers makes it difficult for their survival as they cannot match the price cuts of those retailers. In addition, online games and apps are replacing physical toys as kids become more interested in online games.

Social Responsibility Objective

Some firms pay more attention to addressing the social needs of society, rather than the objective of profit. This is especially true in the health care industry, which has an obligation to society in general. When a life-saving drug or treatment is marketed, profit should not be the main objective.

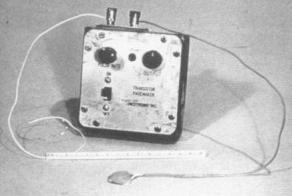

Retrieved from https://www.ncbi.nlm.nih.gov/pmc

/articles/PMC3232561/

Example: Medtronics followed a social responsibility objective in their pricing when they introduced the world's first heart pacemaker.